COC

Export Cameroon CoC Certification Process: Price, Fees, and Duration

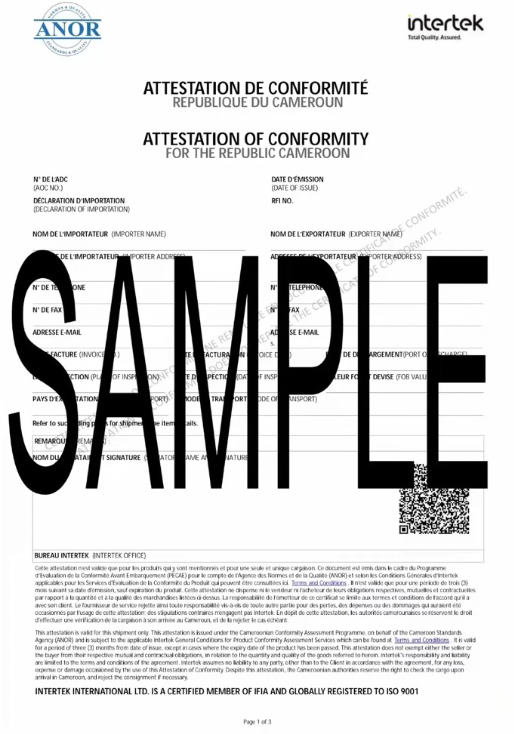

Cameroon coc template

Purpose of PECAE CoC Certification in Cameroon

The government directive on the "Implementation Regulations of the Pre-shipment Conformity Assessment Program" (Order No. 1875 of 2015), mandates that exporters and importers engaging in trade with Cameroon must comply with the requirements set by the Cameroon Standards and Quality Agency (ANOR) regarding the Pre-shipment Evaluation of Compliance Assessment (PECAE) for Cameroon. Failure to adhere to these requirements may result in clearance delays, fines, or even repatriation of goods.

The compliance assessment program verifies whether products, including health and beauty products, processed and unprocessed food, construction materials, finished oils, gas cylinders, and paper products, listed in the controlled products catalog for export to Cameroon, require compliance assessments. If so, exporters must obtain a Certificate of Conformity (CoC) for each batch of regulated goods.

Specific Requirements for PECAE CoC Clearance Certification in Cameroon

Exporters must obtain a Certificate of Conformity (CoC) for each batch of regulated goods, issued only by recognized inspection agencies. These certificates must be submitted to contractors, who then issue Compliance Certificates (CoCs) endorsed by ANOR. Customs clearance mandates the submission of CoCs for each batch of products. Failure to provide a CoC for shipments arriving after August 31, 2016, may result in refusal of clearance and appropriate penalties.

The certificate confirms the product's compliance with relevant Cameroonian technical regulations, national standards, regional standards, or international standards.

According to ANOR's regulations for the PECAE pre-shipment conformity assessment program, exporters must obtain an Attestation de Conformité (AC certificate) for goods listed in the controlled catalog. ANOR then issues a CoC based on the AC certificate, which is delivered to importers as a required clearance document.

Product Lists for PECAE CoC Certification in Cameroon

Products regulated under the Cameroon CoC program include toys and sports equipment, electronic and electrical products, vehicles, chemicals, mechanical materials, and gas products, among others. Certain items are exempt from the program, such as personal items, gemstones, art pieces, explosives, and military equipment.

Required Documents for PECAE CoC Certification in Cameroon

Exporters must submit product test reports, packing lists, invoices, business licenses, and any additional documents deemed necessary by regulatory agencies.

Costs and Fees

The fees for PECAE CoC certification vary based on specific services required. For accurate pricing, contact authorized agencies directly.

Certification Process for PECAE CoC in Cameroon

Exporters submit applications, invoices, packing lists, product quality documents, and factory ISO certificates (if available) to authorized agencies. The certification agency determines the applicable standards and implements feasible assessment plans. Testing, if required, is conducted by accredited laboratories. On-site inspections are carried out at the nearest agency office. After completion, exporters submit final documents to the agency, which issues electronic certificates to clients.

In conclusion, obtaining PECAE CoC certification for Cameroon involves meticulous adherence to regulations and comprehensive documentation. By understanding the requirements and following the prescribed procedures, exporters can ensure compliance and facilitate smooth customs clearance for their shipments.

What is Cameroon Import Tariffs?Last published date: 2021-10-28

Custom duty rates are applicable according to the category of the imported product:

-Primary necessary goods: category I, 0 percent

-Raw materials and equipment goods: category II, 10 percent

-Intermediary and miscellaneous goods: category III, 20 percent

-Fast-moving consumer goods: category IV, 30 percent

Cameroon customs clearance documents

Paid final Taxation Slip;Supplier's final invoice;The freight invoice;The insurance invoice;

Bank receipt certifying payment of import taxes and duties;Bill of lading or sea waybill;

Domiciled Import Declaration;

Bank receipt certifying payment of port charges billed by the PAD;

Contact Information:

Rich Tel: 0755-26996194 Phone&Whatsapp:13530227809

rockycho.sz@gmail.com

____END____

CATEGORIES

ECTN BESC

- China srrc certification application pro2018-08-08

CONTACT US

Contact: COC certificate,pvoc,coi,ectn,besc

Phone: 13641409693

Tel: +86-755-23763628

E-mail: rockychou.sz@gmail.com

Add: Room 2401, Building A, Jingji 100, Shennan East Road, Luohu District, Shenzhen City, Guangdong Province,China