COC

Exporting Coc to Somalia: Customs Clearance Procedures, Application Process and cost

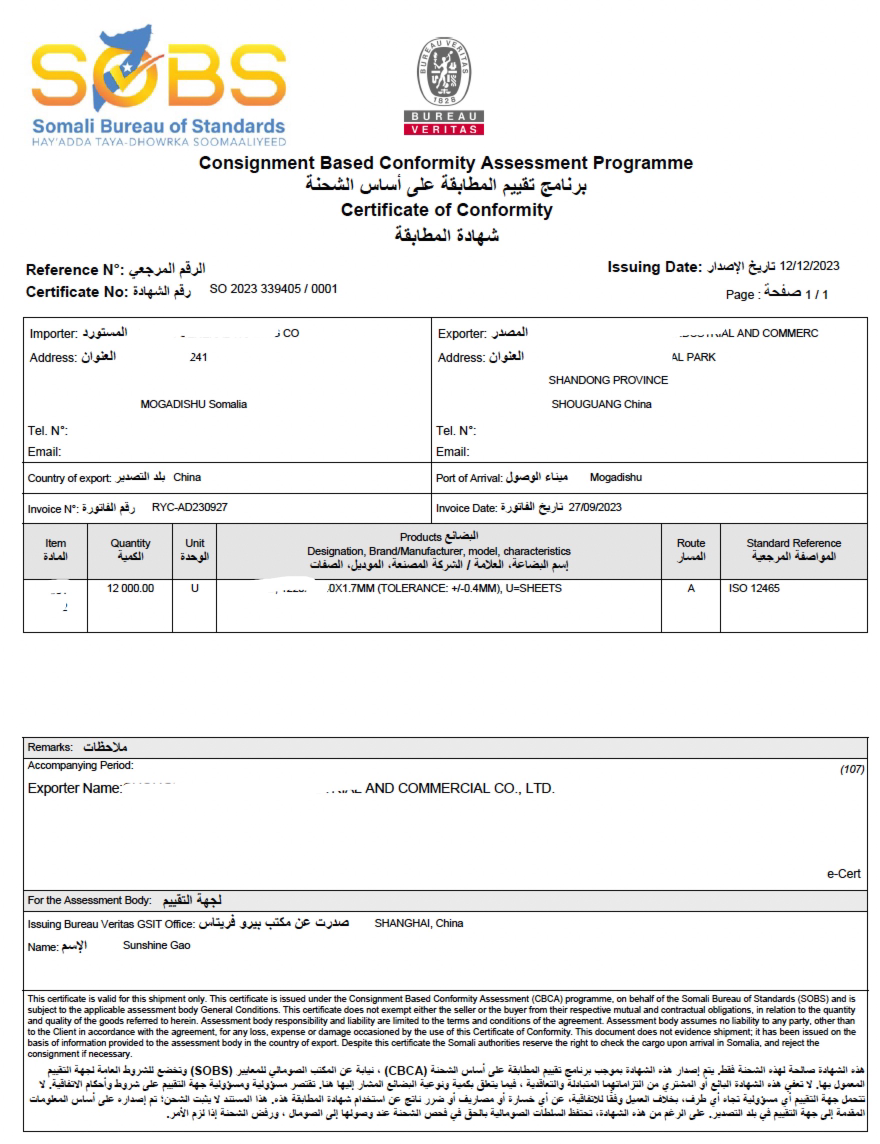

Somali coc certificate template

Certificate of Conformity (Coc) is an important requirement for customs clearance of goods in Somalia. This is a document that ensures imported products meet necessary quality and safety standards.

In this article, we will explore the process of obtaining a Somalia CoC, including application requirements, procedures, fees, and estimated completion time.

Somalia Coc application process:

To apply for the Somali CoC, please follow these general steps:

Product Assessment: Identify specific product categories and determine applicable standards and regulations in Somalia.

Authorized Agency: Contact an authorized certification agency recognized by the Somali authorities. These agencies are responsible for issuing the CoC and conducting the necessary testing and inspections.

Application Submission: Submit required documents to the certification body. These documents typically include application forms, product specifications, manufacturing details and any relevant test reports or certificates.

Product Testing and Evaluation: Certification agencies will conduct testing and evaluation to ensure that products comply with applicable standards. This may involve laboratory testing, sample inspection and document review.

Coc issuance: If the product meets the requirements, the certification body will issue a Somali Coc, indicating that it meets the specified standards.

Somalia Coc application requirements:

The specific documents and information required for a Somalia CoC application may vary by product category. However, typical requirements include:

Product Information: Detailed technical specifications including dimensions, materials, ingredients and features.

Manufacturer details: Information about the manufacturer, such as company name, address, and contact information.

Test Reports: Any relevant test reports conducted by an accredited laboratory or certification body.

Compliance Document: A certificate or statement of compliance with international standards or applicable regulations.

Somalia Coc Fees and Processing Times:

The costs associated with obtaining a Somalia CoC may vary depending on the type of product, the complexity of the testing and the certification body selected.

It is recommended to contact the agency directly for information on specific fees.

Somalia Coc processing time also depends on factors such as product category, availability of testing facilities, and efficiency of the certification body.

Typically, this process can take anywhere from weeks to months. It is recommended to start the application early to allow sufficient processing time.

Customs clearance procedures:

Once the Somali CoC is obtained, it plays a vital role in the customs clearance procedure. During customs clearance, CoC serves as evidence that the product complies with relevant standards and regulations.

Customs officials will review the COC as well as other required import documents to ensure compliance before the goods enter the country.

It is important to note that customs clearance procedures in Somalia may involve additional requirements and processes, such as duties, inspections, and documentation.

Importers should consult with customs authorities or freight forwarders to obtain accurate and up-to-date information on the specific customs clearance procedures applicable to their shipments.

In short, obtaining a Somali CoC is an important step in customs clearance of goods in Somalia. By following the application process, meeting the necessary requirements, and working with an authorized certification body,

Importers can ensure compliance with applicable standards. It is recommended to plan ahead, allocate sufficient processing time, and stay informed about customs clearance procedures,

To facilitate a smooth import process into Somalia.

Somalia import documents,

Certificate of incorporation provided by MOCI, which must have a license to import

Certificate of origin, mandatory for all imports

Original bill of lading

Bill of lading/airway bill, issued by the shipping company

Packing list that covers description of items imported

Import permit, applies to all restricted goods and may be issued in advance by sector regulatory agencies

A commercial invoice showing products and value

Phytosanitary certificate for agricultural produce or health certification

A tax certificate is required for registered companies

Insurance certificate

A pre-shipment inspection certificate has been introduced.

Somalia import tariffs,

Somalia uses the Harmonized System (HS) Customs Code to classify goods for tax purposes. Unless imported goods qualify as aid or have prior approval for tax exemption, all imports are subjected to import duty at entry based on the Customs Tariff Schedule annexed to the Somali Customs Tariff Law of 2022. It is important to get the latest updates on tariffs before importation. Somalia currently has the lowest taxation in the region. Value Added Tax (VAT) and other fees and charges may apply to specific consignments. According to the recent Somali Customs law, import duty is assessed on the Cost Insurance Freight (CIF) value of the good. VAT and other fees and charges are assessed on CIF + duty. An existing Financial Management Information System (FMIS) provides basic revenue receipting and Tax Identification Number (TIN) generation functionalities for Inland Revenue collections.

Business Contacts

Rich Tel: 0755-26996194 Phone&Whatsapp:13530227809

rockycho.sz@gmail.com

cooperative customers

——————END——————

CATEGORIES

ECTN BESC

- China srrc certification application pro2018-08-08

CONTACT US

Contact: COC certificate,pvoc,coi,ectn,besc

Phone: 13641409693

Tel: +86-755-23763628

E-mail: rockychou.sz@gmail.com

Add: Room 2401, Building A, Jingji 100, Shennan East Road, Luohu District, Shenzhen City, Guangdong Province,China